India’s Startups Raise $272.1 Million Across 18 Deals, Led by Healthtech, Consumer Services & Enterprise Tech

- August 20, 2025

- Posted by: spiceroute

- Category: Startup Funding Insights

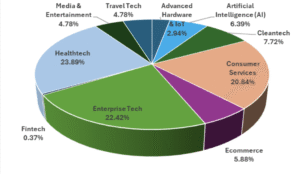

India’s startup ecosystem saw 18 startups raise a total of $272.1 million this week. Healthtech led funding with $65 million raised by Truemeds, targeting online pharmacy scale-up in Series C. Consumer Services attracted $56.7 million, led by Zepto’s $45.7 million round in quick commerce. Enterprise Tech secured $61 million, driven by late-stage and Series A rounds in B2B HR Tech and vertical SaaS. Cleantech and Artificial Intelligence also had noteworthy activity at $21 million and $17.4 million respectively.

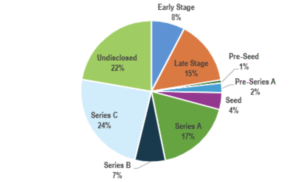

Funding stages were well-mixed, with large Series C and late-stage deals dominating headline numbers, alongside strong Series A and early-stage momentum across sectors.

Sector Highlights

Healthtech ($65M)

Truemeds led the sector with a $65 million Series C round supporting online pharmacy and tech-enabled distribution, marking continued investor preference for scaleable digital health solutions.

Consumer Services ($56.7M)

Zepto’s $45.7 million undisclosed round powered quick commerce growth, with diverse funding for hyperlocal and digital service providers expanding across Indian metros.

Enterprise Tech ($61M)

Major investments in B2B HR Tech (Darwinbox, $40 million) and vertical SaaS (Arintra, $21 million Series A) highlighted investor confidence in platform-driven enterprise solutions.

Cleantech ($21M)

Ultraviolette raised $21 million to push electric vehicle innovation, showing rising interest in sustainable transportation and climate technologies.

Artificial Intelligence (AI) ($17.4M)

AI companies like Graas.ai ($9M Series B) and Refold AI ($6.5M Seed) received funds for AI-powered e-commerce, product engineering, and digital optimization.

Media & Entertainment ($13M)

Dashverse secured $13 million Series A for digital content and creator-driven growth, reinforcing investment interest in media platforms.

Top Funded Startups

| Rank | Startup | Sector | Funding Amount (USD) | Funding Stage | Use of Funds |

| 1 | Truemeds | Healthtech (Online Pharmacy) | $65,000,000 | Series C | Scale-up digital pharmacy platform |

| 2 | Zepto | Consumer Services (Quick Commerce) | $45,700,000 | Undisclosed | Market expansion & logistics |

| 3 | Darwinbox | Enterprise Tech (HR Tech) | $40,000,000 | Late Stage | Platform expansion |

| 4 | Ultraviolette | Cleantech (Electric Vehicles) | $21,000,000 | Early Stage | EV innovation & scale-up |

| 5 | Arintra | Enterprise Tech (Vertical SaaS) | $21,000,000 | Series A | SaaS product & growth |

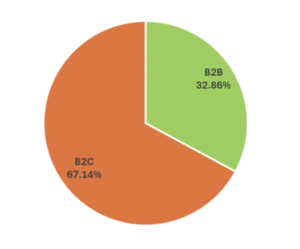

Customer Segment Analysis

- B2C startups accounted for $182.7 million, led by healthtech, consumer services, cleantech, and travel tech, showing investor appetite for accessible and consumer-facing innovation.

- B2B startups raised about $89.4 million, driven by enterprise tech, AI, advanced hardware, and horizontal marketplaces, indicating ongoing faith in business problem-solving models.

- Hybrid and crossover models made up a modest share of activity this week.

Funding Stage Breakdown

Large Series C rounds led headline figures at $65 million, with late-stage and Series A deals combining for strong totals ($40 million and $48 million respectively). Early-stage activity was steady, with Seed, Pre-Series A, and Pre-Seed rounds collectively delivering over $18.9 million. Notably, several significant rounds were undisclosed, including Zepto’s $45.7 million and others, reinforcing broad funding momentum.

Key Takeaways

- Healthtech, Consumer Services, and Enterprise Tech lead capital inflows, showing sectoral shift toward scalable platforms, logistics, and digital-first healthcare.

- Investors remain focused on growth and late-stage deals for proven business models, but strong early-stage activity signals robust innovation pipeline.

- B2C startups outpaced B2B in total funding, yet enterprise-focused solutions and tech platforms continue to capture meaningful funding and partnership interest.

- Sustained investment in AI, cleantech, and media highlights market opportunities beyond traditional tech, reflecting evolving investor priorities.

- Overall ecosystem confidence remains high, with funding distributed across stages and diverse sectors powering India’s startup growth story.