US Funding Insights: Emerging Strength in AI and Concentrated Hubs

- September 1, 2025

- Posted by: spiceroute

- Category: U.S. Funding & Investment Trends

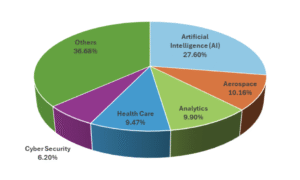

This week, 63 US startups collectively raised approximately $758 million in equity funding. The data highlights a steady and resilient venture capital ecosystem. Artificial Intelligence (AI) remained the dominant sector, securing nearly $209 million across 24 companies. Other significant sectors drawing substantial investment include Aerospace ($77 million), Analytics ($75 million), and Health Care ($72 million).

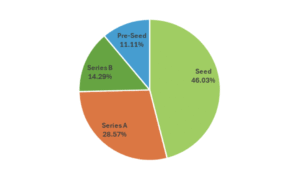

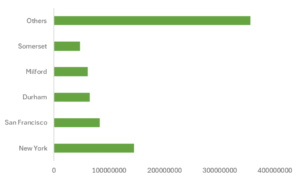

In terms of funding stages, Series B rounds topped capital raised with $278 million across 9 deals, followed by Series A at $341 million (18 deals). Seed rounds raised $135 million in 29 deals, and Pre-Seed rounds totaled about $4.1 million across 7 deals. Geographically, New York led with $145 million across 11 startups, followed by San Francisco with $83 million (9 startups), Durham ($65 million), and Milford ($61 million).

The market outlook indicates measured confidence in startup growth and exits, with active funding spanning various stages and sectors.

Top Industries of the Week:

Artificial Intelligence (AI): $209 million (24 companies)

AI continues to attract robust investor interest, driven by innovations in machine learning, natural language processing, and applied AI technologies across multiple industries. Key deals include Topline Pro ($27 million Series B, New York) and Hyphen ($25 million Series B, San Jose), highlighting ongoing growth across funding stages.

Aerospace: $77 million (2 companies)

Investments like Vulcan Elements ($65 million Series A, Durham) demonstrate strong capital flow into aerospace technology and manufacturing.

Analytics: $75 million (3 companies)

Training data and analytics startups such as Profound ($35 million Series B, New York) are gaining significant funding.

Health Care: $72 million (4 companies)

Funding continues for health care startups such as Reprieve Cardiovascular ($61 million Series B, Milford), signaling ongoing trust in health innovation.

Additional sectors include Cyber Security ($47 million), Consulting ($24 million), Freight Service ($25 million), and Customer Service ($23 million), showing a broad and diversified investment landscape.

Funding Stage Analysis:

Series A: $341 million (18 deals)

Series A capital surged with strong deals from companies like Arintra ($21 million, Austin) and Citizen Health ($30 million, San Mateo), underscoring scaling startups’ momentum.

Series B: $278 million (9 deals)

Mature startups attracted $278 million, including top rounds from Profound and Topline Pro, reflecting confidence in proven models.

Seed: $135 million (29 deals)

Seed funding remains foundational, supporting early venture growth with companies like XOPS ($40 million, Pleasanton) and Mesa ($24 million, Austin).

Pre-Seed: $4 million (7 deals)

Pre-Seed rounds maintain critical support for nascent startups.

Outliers: Top Funded Startups

| Rank | Company | Sector | Funding | Stage | Location |

| 1 | Apreo Health | Health Care | $61 million | Series B | Milford |

| 2 | Vulcan Elements | Aerospace | $65 million | Series A | Durham |

| 3 | Profound | Analytics, AI | $35 million | Series B | New York |

| 4 | 1Kosmos | Cyber Security | $47 million | Series B | Somerset |

| 5 | Topline Pro | Artificial Intelligence | $27 million | Series B | New York |

| 6 | Hyphen | Artificial Intelligence | $25 million | Series B | San Jose |

| 7 | GoodShip | Freight Service | $25 million | Series B | Nashville |

| 8 | Arintra | Artificial Intelligence | $21 million | Series A | Austin |

| 9 | Citizen Health | Artificial Intelligence | $30 million | Series A | San Mateo |

| 10 | XOPS | Information Technology | $40 million | Seed | Pleasanton |

Geographic Highlights:

New York led with $145 million across 11 startups, reaffirming its position as a key funding hub. San Francisco followed with $83 million (9 companies), Durham raised $65 million (2 companies), and Milford attracted $61 million. Additional active cities include Somerset ($47 million), Austin ($45 million), Pleasanton ($40 million), and San Jose ($25 million).

Key Takeaways:

- Hub Concentration: New York and San Francisco remain critical centers absorbing the majority of venture capital, followed by Durham and Milford emerging as noteworthy contributors.

- Sector Focus: Artificial Intelligence leads closely, supported by significant Aerospace, Analytics, and Health Care investments.

- Stage Distribution: Series A rounds showed strong growth with large fund inflows, while Series B funding indicates continued maturation of high-potential startups.

- Geographic Reach: Investment activity in cities beyond traditional hubs like Somerset, Pleasanton, and Austin reflects gradual geographic diversification.

Final Thoughts:

This week’s funding totaling $758 million across 63 startups reflects an active and maturing US venture ecosystem, with AI and health tech fueling the majority of capital deployment. Leading hubs continue to dominate, while investments in emerging clusters point to a broadening startup landscape. The balance of early to late-stage funding rounds underscores robust market confidence and continued opportunities for growth and exit strategies.