US Funding Insights: Clean Energy and AI Drive a Record Week

- September 4, 2025

- Posted by: spiceroute

- Category: U.S. Funding & Investment Trends

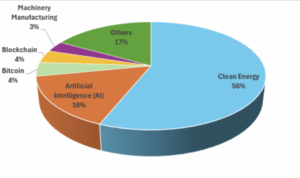

This week, 74 US startups collectively raised approximately $1.54 billion in equity funding, showcasing robust activity in the venture capital landscape. Clean Energy surged ahead with a remarkable $863 million raised largely by Commonwealth Fusion Systems in Cambridge. Artificial Intelligence (AI) continued its strong presence, securing $242 million across 21 companies. Other key sectors included Bitcoin ($65 million), Blockchain ($58 million), and Machinery Manufacturing ($50 million).

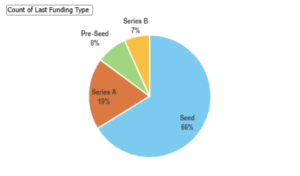

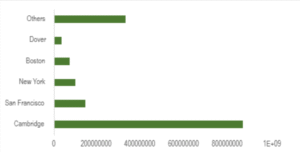

In funding stages, Series A rounds led capital deployment with $319 million raised across 18 deals, followed by Series B with $281 million over 9 companies. Seed rounds maintained vitality, raising $233 million from 49 deals, while Pre-Seed rounds totaled approximately $1.2 million over 6 deals. Geographically, Cambridge dominated funding with $863 million invested, followed by San Francisco with $142 million, and New York with $97 million.

The market reflects growing confidence in transformative clean energy technologies alongside sustained AI innovation and healthy early-stage deal flow.

Top Industries of the Week:

- Clean Energy: $863 million (1 company)

Dominated by the extraordinary Series B round of Commonwealth Fusion Systems in Cambridge, clean energy innovation led the funding surge. - Artificial Intelligence (AI): $242 million (21 companies)

AI continues to attract broad investor attention, with notable deals including Assort Health ($50 million Series B, San Francisco) and InstaLILY AI ($25 million Series A, New York).

- Bitcoin & Blockchain: $123 million combined

Stable funding activity in the cryptocurrency and blockchain sectors underscores continued investor interest, supported by Rain’s $58 million Series B in New York.

- Machinery Manufacturing: $50 million

Startups like Blue Water Autonomy leveraged capital to advance manufacturing and maritime technologies.

- Other important sectors include Health Care ($14 million), PropTech, and Finance, contributing to a diversified capital distribution.

Funding Stage Analysis:

- Series A: $319 million (18 deals)

Key growth-stage investments drive this lead, with major rounds in AI, medical tech, and finance sectors.

- Series B: $281 million (9 deals)

Continued investor commitment to scaling companies is evident, anchored by large clean energy and AI deals.

- Seed: $233 million (49 deals)

Early-stage funding activity remains robust, ensuring fresh innovation feeds into the pipeline.

- Pre-Seed: $1.2 million (6 deals)

Smaller rounds continue to nurture promising nascent startups.

Outliers: Top Funded Startups

| Rank | Company | Sector | Funding | Stage | Location |

| 1 | Commonwealth Fusion Systems | Clean Energy | $863 million | Series B | Cambridge |

| 2 | Rain | Blockchain | $58 million | Series B | New York |

| 3 | Blue Water Autonomy | Machinery Manufacturing | $50 million | Series A | Boston |

| 4 | Assort Health | Artificial Intelligence | $50 million | Series B | San Francisco |

| 5 | Portal to Bitcoin | Bitcoin | $50 million | Series A | San Francisco |

| 6 | OpenLight | Information Technology | $34 million | Series A | Goleta |

| 7 | The Better Meat Co. | Alternative Protein | $31 million | Series A | West Sacramento |

| 8 | Pylon | B2B | $31 million | Series B | San Francisco |

| 9 | Zed Industries | Creative Agency | $32 million | Series B | San Francisco |

| 10 | TinyFish | Artificial Intelligence | $47 million | Series A | Palo Alto |

Geographic Highlights:

Cambridge overwhelmingly dominated with $863 million invested, reaffirming its emerging role as a clean energy capital. San Francisco followed with $142 million across 8 startups, emphasizing its leadership in AI and technology innovation. New York raised $97 million, with Boston and Dover also making notable contributions.

Key Takeaways:

- Clean Energy Breakout: Commonwealth Fusion Systems’ massive funding round signals transformative investor interest in sustainable energy solutions.

- Strong AI Presence: AI startups remain a vital engine of innovation and funding growth.

- Hub Expansion: Cambridge joins traditional hubs like San Francisco and New York at the forefront of venture activity.

- Broad Sector Activity: Diverse funding across blockchain, machinery manufacturing, and health care indicates a healthy ecosystem balance.

- Early-Stage Strength: High seed deal volume ensures continued startup pipeline vitality.

Final Thoughts:

This week’s impressive $1.54 billion funding total signals a healthy and vibrant US startup ecosystem led by breakthrough clean energy and enduring AI innovation. With key hubs expanding and early-stage activity flourishing, the environment is poised for sustained growth and impactful technological advancement in the coming months.