Indian Startups Raise $134.48 Million Across 22 Deals, Led by Enterprise Tech & AI

- August 20, 2025

- Posted by: spiceroute

- Category: Startup Funding Insights

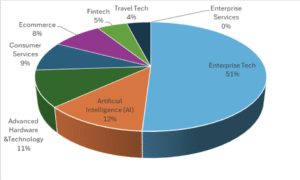

India’s startup ecosystem saw 22 startups raise a total of $134.48 million this week across diverse sectors. Enterprise Tech led funding with $68.55 million raised over 4 deals, reflecting strong investor interest in SaaS and B2B solutions. Artificial Intelligence startups attracted $16.4 million, while Advanced Hardware & Technology secured $14.5 million. Consumer Services and Ecommerce (D2C) companies raised $11.73 million and $11.2 million respectively. Fintech and Travel Tech rounds brought in $6.69 million and $5.4 million.

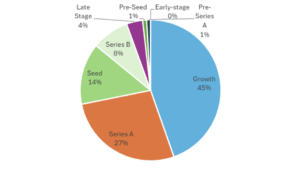

Growth-stage and Series A rounds dominated this week’s investment, although early-stage deals in Seed and Pre-Series A stages remain robust. A few startups reported undisclosed or zero funding amounts, likely early-stage or launch rounds.

Sector Highlights

Enterprise Tech ($68.55M)

Enterprise SaaS continued to dominate funding, led by Gupshuup’s large growth round. The sector remains a key investor favorite, driven by scalable solutions for B2B markets and global expansion ambitions.

Artificial Intelligence (AI) ($16.4M)

AI startups secured solid seed and early-stage funding focused on product development and market entry, reflecting investor belief in AI’s broad application potential across industries.

Advanced Hardware & Technology ($14.5M)

Funding mainly targeted semiconductor research and manufacturing, highlighting continued interest in strategic tech sectors critical to India’s emerging deeptech landscape.

Consumer Services ($11.73M)

Consumer-focused startups showed steady funding with emphasis on regional expansion and scaling operations into Tier II and III cities.

Ecommerce (D2C) ($11.2M)

Ecommerce brands remain active in fundraising, targeting product diversification and growth through digital channels and tiered market penetration.

Fintech ($6.69M)

Investments focused on lending tech and payment solutions, supporting startups in user acquisition and product enhancement in a competitive financial services space.

Travel Tech ($5.4M)

Funding supported innovative mobility solutions, including EV-based subscriptions, reflecting evolving consumer preferences and sustainable transport trends.

Top Funded Startups

| Rank | Startup | Sector | Funding Amount (USD) | Funding Stage | Use of Funds |

| 1 | Gupshuup | Enterprise Tech (SaaS) | 60,000,000 | Growth | Global market expansion and growth |

| 2 | Netrasemi | Advanced Hardware | 12,400,000 | Series A | Semiconductor R&D, manufacturing, SoC variants rollout |

| 3 | SuperK | Consumer Services | 11,500,000 | Series B | Team expansion and entry into 300 new towns |

| 4 | Kluisz.ai | Artificial Intelligence | 9,600,000 | Seed | Product development, engineering, GTM buildout |

| 5 | EduFund | Fintech (Lendingtech) | 6,000,000 | Series A | Operations enhancement, user acquisition |

| 6 | EVeez | Travel Tech | 5,400,000 | Series A | Expansion of electric two-wheeler subscription services |

| 7 | Enlite Research | Enterprise Tech (Vertical SaaS) | 5,300,000 | Series A | Global market expansion and strengthening India presence |

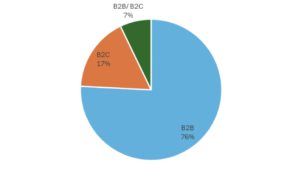

Customer Segment Analysis

- B2B startups accounted for $101.95 million, dominating the volume led by enterprise tech, AI, hardware, and fintech sectors.

- B2C startups raised about $22.93 million, concentrating in consumer services, ecommerce, and D2C sectors.

- Hybrid (B2B/B2C) companies like Kluisz.ai attracted mixed-segment funding worth approximately $9.6 million.

Funding Stage Breakdown

This week’s funding showcased a strong preference for the B2B customer segment, which secured a dominant $101.95 million. This significant capital inflow, representing nearly 76% of total funds, underscores robust investor confidence in enterprise solutions. Key B2B investments targeted areas such as enterprise SaaS (Gupshuup, Enlite Research), advanced hardware (Netrasemi), and AI applications (Kluisz.ai), highlighting a focus on enhancing business operations and infrastructure across multiple industries.

Meanwhile, B2C startups raised $22.93 million, demonstrating continued investor interest in consumer services and direct-to-consumer (D2C) ecommerce models. Notable funding went into consumer services (SuperK) and ecommerce brands targeting regional expansion. Additionally, a hybrid B2B-B2C segment attracted approximately $9.6 million, reflecting emerging business models blending enterprise and consumer solutions.

The overall distribution points to a strategic emphasis on foundational B2B innovation driving the Indian startup ecosystem, complemented by strong support for B2C ventures expanding direct market reach and user engagement, with hybrid segments adding further diversity to investor portfolios.

Key Takeaways

- Enterprise Tech leads funding in both volume and deal size, reflecting continued belief in SaaS and scalable B2B solutions.

- AI startups remain a key focus with growing seed and series A investments, highlighting innovation in application software and platforms.

- Advanced Hardware startups maintain traction, especially in semiconductors and defence tech sectors.

- Consumer-focused startups in Ecommerce and Services continue regional expansion, targeting Tier II and III cities.

- Early-stage investment activity remains healthy, ensuring fresh innovation entering the ecosystem.

- Undisclosed or $0 valued deals represent typical early-stage rounds or pre-announcements.