India’s Startups Raise $103.6 Million Across 14 Deals, Led by Enterprise Tech & AI

- August 20, 2025

- Posted by: spiceroute

- Category: Startup Funding Insights

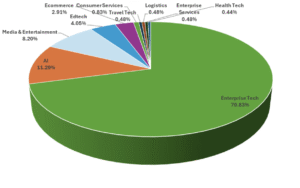

India’s startup ecosystem saw 14 startups raise a total of $103.6 million this week across diverse sectors. Enterprise Tech led funding with $73.4 million raised over 5 deals, reflecting strong investor interest in SaaS and B2B solutions. Artificial Intelligence startups attracted $11.7 million, while Media & Entertainment secured $8.5 million. Edtech, Ecommerce, and Consumer Services companies raised $4.2 million, $3 million, and $860 thousand respectively.

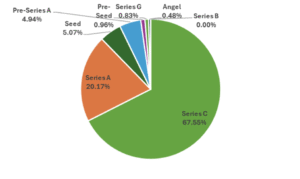

Growth-stage and Series A rounds dominated this week’s investment, although early-stage deals in Seed, Pre-Series A, and Angel stages remain active, highlighting continued vibrancy in the startup ecosystem. A few startups reported zero or undisclosed funding amounts, likely representing very early-stage or strategic partnership rounds.

Sector Analysis

Enterprise Tech ($73.4M)

Enterprise SaaS continued to dominate funding, led by Safe Security’s sizeable growth round. The sector remains a key investor favorite, driven by scalable solutions for B2B markets and global expansion ambitions.

Artificial Intelligence (AI) ($11.7M)

AI startups secured solid Series A and early-stage funding focused on product development and market penetration, reflecting investor belief in AI’s broad application potential across industries.

Media & Entertainment ($8.5M)

Funding in this sector centered on gaming and content platforms, emphasizing engagement and consumer retention in emerging digital entertainment models.

Edtech ($4.2M)

Edtech investments supported expansion into new markets with a focus on improving AI capabilities and boosting marketing efforts.

Ecommerce (D2C) ($3M)

Ecommerce brands remained active in fundraising, targeting product diversification and growth through digital channels and tiered market penetration.

Consumer Services ($860K)

Consumer-focused startups showed steady funding with emphasis on regional expansion and scaling operations.

Top Funded Startups

| Rank | Startup | Sector | Funding Amount (USD) | Funding Stage | Use of Funds |

| 1 | Safe Security | Enterprise Tech (SaaS) | 70,000,000 | Series C | Build AI tools for autonomous cyber governance |

| 2 | Metaforms | Artificial Intelligence | 9,000,000 | Series A | Develop AI workflows for market research agencies |

| 3 | STAN | Media & Entertainment | 8,500,000 | Series A | Build social platform for Gen Z gamers |

| 4 | Sharpsell.ai | Enterprise Tech | 3,400,000 | Series A | Expand AI agents and deepen market presence |

| 5 | Arivihan | Edtech | 4,200,000 | Pre-Series A | Expansion, AI improvements, marketing |

Hybrid (B2B/B2C) startups like Sharpsell.ai attracted mixed-segment funding worth $3.4 million

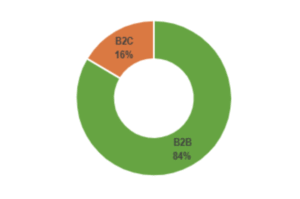

Customer Sector Analysis

- B2B startups accounted for approximately $86.6 million, dominating the volume led by enterprise tech, AI, and media verticals.

- B2C startups raised about $17 million, concentrating in media, ecommerce, and consumer services sectors.

- Hybrid (B2B/B2C) startups like Sharpsell.ai attracted mixed-segment funding worth approximately $3.4 million.

Funding Stage Breakdown

This week’s funding showcased a strong preference for the B2B customer segment, which secured the majority of capital at approximately $86.6 million. This significant inflow underscores robust investor confidence in enterprise solutions. Key B2B investments targeted areas such as enterprise SaaS (Safe Security, Sharpsell.ai), AI applications (Metaforms), and media platforms (STAN), highlighting a focus on enhancing business operations and infrastructure across multiple industries.

Meanwhile, B2C startups raised $17 million, demonstrating continued investor interest in consumer services and ecommerce models aimed at regional expansion. Additionally, a hybrid B2B-B2C segment attracted approximately $3.4 million, reflecting emerging business models blending enterprise and consumer solutions.

The overall distribution points to a strategic emphasis on foundational B2B innovation driving the Indian startup ecosystem, complemented by strong support for B2C ventures expanding direct market reach and user engagement, with hybrid segments adding further diversity to investor portfolios.

Key Takeaways

- Enterprise Tech accounted for the highest funding share, demonstrating investors focus on scalable SaaS and security solutions.

- AI remains the second-largest sector, highlighting continued enthusiasm for applied AI platforms.

- B2B startups dominated funding, confirming strong investor preference for business-centric solutions though consumer startups maintain meaningful capital inflows.

- Growth and Series A rounds led the funding volumes, illustrating investor confidence in companies advancing beyond early validation.

- Early-stage investments persist, sustaining a diverse innovation pipeline across Indian startup sectors.