India’s Startups Raise $197.4 Million Across 25 Deals, Led by Ecommerce & Fintech

- August 20, 2025

- Posted by: spiceroute

- Category: Startup Funding Insights

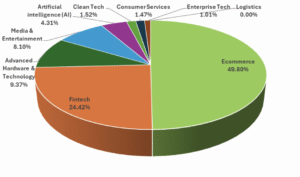

India’s startup ecosystem saw 25 startups raise a total of $197.4 million this week. Ecommerce led funding with $98.3 million raised over multiple deals, driven by large-scale growth rounds, particularly in direct-to-consumer (D2C) brands. Fintech startups attracted $48.2 million, led by debt and Series A rounds aiming at lending tech and payment innovations. Advanced Hardware & Technology received $18.5 million, while Media & Entertainment and Artificial Intelligence secured $16 million and $8.5 million respectively.

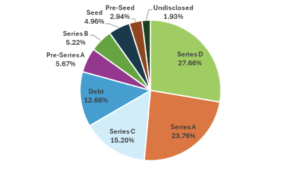

Funding stages were diverse, with notable Series D and Series A rounds dominating, though early-stage Seed and Pre-Series A rounds remained active, supporting new ventures across AI, consumer sectors, and hardware.

Sector Highlights

Ecommerce ($98.31M)

Direct-to-consumer ecommerce brands drove funding this week, with significant support for scaling product innovation, supply chain enhancement, and geographic expansion into Tier II and III markets.

Fintech ($48.2M)

Fintech startups attracted funding primarily through lending and insurtech solutions, with significant debt funding focused on lending expansion and digital financial services.

Advanced Hardware & Technology ($18.5M)

Funding concentrated on aerial vehicles, IoT hardware, and space technology, underscoring growing investor interest in strategic, capital-intensive tech.

Media & Entertainment ($16M)

Gaming and digital content platforms raised capital to scale proprietary technology and expand into global markets.

Artificial Intelligence (AI) ($8.5M)

AI investments targeted application-layer solutions and workflow tools designed to enhance enterprise performance.

Consumer Services ($2.9M)

Funding supported quick-commerce and consumer mapping/location-based services focusing on user adoption and market growth.

Top Funded Startups

| Rank | Startup | Sector | Funding Amount (USD) | Funding Stage | Use of Funds |

| 1 | The Sleep Company | Ecommerce (D2C) | 54,600,000 | Series D | Scale manufacturing, deepen offline presence, expand product range |

| 2 | RENEE Cosmetics | Ecommerce (D2C) | 30,000,000 | Series C | Fuel product innovation, retail expansion, marketing |

| 3 | Fibe | Fintech (Lending Tech) | 25,000,000 | Debt | Lending boost and digital expansion |

| 4 | SuperGaming | Media & Entertainment (Gaming) | 15,000,000 | Series A | Scale proprietary platform and expand flagship game internationally |

| 5 | Jeh Aerospace | Advanced Hardware (Aerial Vehicles) | 11,000,000 | Series A | Scale manufacturing infrastructure and operations |

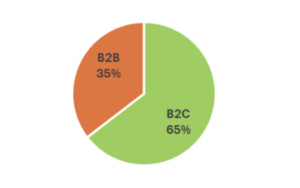

Customer Segment Analysis

B2C startups accounted for approximately $127.5 million, driven by ecommerce D2C and media sectors.

B2B startups raised about $69.9 million, led by fintech, advanced hardware, and AI sectors.

Hybrid B2B/B2C companies appeared less prominently this week but remain part of the ecosystem narrative.

Funding Stage Breakdown

This week presented strong growth-stage activity, with Series D leading at $54.6 million, followed by Series A rounds totaling nearly $47 million focused on scaling and expansion. Debt financing also played a key role with $25 million raised primarily in fintech. Early-stage rounds like Seed and Pre-Series A combined raised around $19.8 million, supporting product development and market entry for emerging startups. Undisclosed rounds accounted for close to $3.8 million.

Key Takeaways

- Investor Confidence in Ecommerce & Fintech: Large-scale funding in ecommerce and fintech highlights investor trust in these sectors’ growth and innovation potential.

- Diversification Across Strategic Technologies: Advanced hardware and AI secured meaningful funding, spotlighting sustained interest in deep tech and enterprise solutions.

- Growth-Stage Dominance: Series D and A rounds dominated funding volumes, emphasizing scaling potential as a primary investor focus.

- Healthy Early-Stage Activity: Seed and Pre-Series A deals reinforce strong ongoing innovation and startup pipeline growth.

- B2C Leads Funding, But B2B Maintains Strong Presence: Consumer-facing startups drew the largest funds, yet B2B sectors remain foundational and attractive for investors.