India’s Startups Raise $62.1 Million Across 9 Deals, Led by Ecommerce and Fintech

- September 1, 2025

- Posted by: spiceroute

- Category: Startup Funding Insights

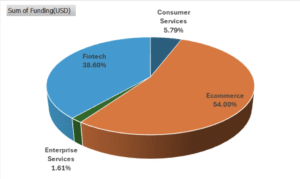

India’s startup ecosystem saw 9 startups raise a total of $62.1 million this week. Ecommerce led funding with $33.6 million, driven by R For Rabbit’s $27 million Series B round to expand omnichannel distribution, product innovation, and digital initiatives. Fintech attracted $24 million, with Kiwi’s $24 million Series B round to improve tech and user reach for UPI credit payments. Consumer Services accounted for the remaining funding, led by House of Biryan’s undisclosed round to scale foodtech operations.

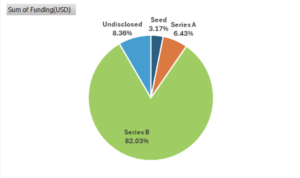

Funding stages were dominated by Series B rounds totaling $51 million, complemented by early-stage Seed and Series A deals supporting growth and innovation.

Sector Highlights

Ecommerce ($33.6M)

D2C ecommerce brands saw robust funding to strengthen manufacturing, R&D, and market expansion.

Fintech ($24M)

Investments centered on lending tech and payment solutions, underpinning fintech scale-ups.

Consumer Services ($3.6M)

Consumer services funding supported business scaling and expansion in foodtech and quick commerce.

Top Funded Startups

| Rank | Startup | Sector | Funding Amount (USD) | Funding Stage | Use of Funds |

| 1 | R For Rabbit | Ecommerce (D2C) | $27,000,000 | Series B | Expand omnichannel distribution and digital initiatives |

| 2 | Kiwi | Fintech | $24,000,000 | Series B | Improve tech, expand UPI credit payments usage |

| 3 | Beyond Appliances | Ecommerce (D2C) | $4,000,000 | Series A | Strengthen manufacturing and R&D |

| 4 | House Of Biryan | Consumer Services | $3,600,000 | Undisclosed | Scale foodtech business to 120–150 locations |

| 5 | Mitra | Ecommerce (D2C) | $1,600,000 | Undisclosed | Improve efficiency and output |

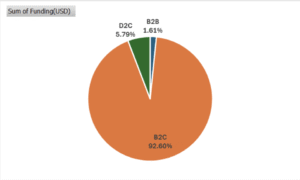

Customer Segment Analysis

- B2C startups raised approximately $57.6 million, led by ecommerce, fintech, and consumer services sectors.

- B2B startups raised about $1 million, reflecting early-stage investments in enterprise services.

Funding Stage Breakdown

Series B rounds dominated funding with $51 million, signaling a strong growth-stage momentum. Early-stage rounds (Seed, Series A) combined contributed roughly $6 million, backing innovation and early growth. Undisclosed rounds represented about $5.2 million, indicating steady private investments.

Key Takeaways

- Growth-stage rounds, led by R For Rabbit and Kiwi’s $27M and $24M Series B raises, dominated funding, emphasizing investor confidence in scaling startups.

- Ecommerce (D2C) and fintech sectors continued to be core investor focus areas, highlighting growth in consumer-focused digital services and financial tech.

- Early-stage investment activity remained healthy, particularly in ecommerce, fostering the innovation pipeline.

- B2C investments notably outpaced B2B contributions this week, though B2B continues to sustain foundational startup activity.

- Sustained interest across sectors reflects a mature, evolving ecosystem balancing growth and innovation.