India’s Startups Raise $98.2 Million Across 18 Deals, Led by Lending Tech, Fintech SaaS & Ecommerce

- September 4, 2025

- Posted by: spiceroute

- Category: Startup Funding Insights

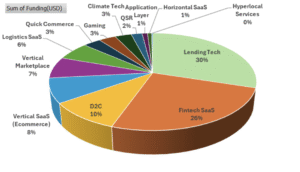

India’s startup ecosystem saw 18 startups raise a total of $98.2 million this week. Lending Tech led total sector funding with $29.4 million, driven by Altum Credo’s undisclosed $19.4M round and CredRight’s $10M Series B round focused on expanding credit access to underserved micro-enterprises. Fintech SaaS segment closely followed with $25 million, led by TransBnk’s $25 million Series B round targeting global expansion of its API-driven transaction banking platform. Ecommerce startups raised $16.6 million, including Vutto’s $7M Series A and Palmonas’ $6.2M Series A rounds scaling vertical marketplaces and D2C brands. Enterprise Tech raised $8.7 million, led by WizCommerce’s Series A for AI-powered SaaS expansion. Other sectors such as Consumer Services, Media & Entertainment, Cleantech, and Foodtech also contributed meaningful funding.

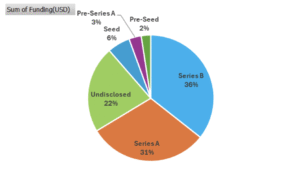

Funding stages showed diversity, led by Series B rounds totaling $35 million, followed by Series A with $30 million, early-stage rounds (Seed, Pre-Series A, Pre-Seed) summing to about $11 million, and undisclosed rounds accounting for nearly $21.8 million.

Sector Highlights

Lending Tech ($29.4M)

Leading the funding, lending tech startups attracted $29.4 million, driven by investments in companies such as Altum Credo and CredRight. This highlights investor focus on digital credit and microfinance solutions catering to underserved markets in India.

Fintech SaaS ($25M)

Fintech SaaS platforms, including TransBnk’s API-driven transaction banking, raised $25 million, emphasizing technology-enabled financial services expansion domestically and internationally.

Ecommerce ($16.6M)

Funding centered on vertical marketplaces and D2C ecommerce brands focused on product innovation, omnichannel growth, and supply chain improvements.

Enterprise Tech ($8.7M)

Funds aimed at vertical SaaS and horizontal SaaS applications demonstrated confidence in AI-enabled enterprise solutions improving B2B operations.

Consumer Services ($3.5M)

Quick commerce, hyperlocal services, and foodtech startups secured funding to scale operations and improve market reach.

Media & Entertainment ($3.1M)

Gaming sector funding assisted startups in marketing expansion and product diversification.

Cleantech and Foodtech ($5M Combined)

Cleantech investments targeted climate tech R&D, while foodtech funding supported national expansion ambitions.

Top Funded Startups

| Rank | Startup | Sector | Funding Amount (USD) | Funding Stage | Use of Funds |

| 1 | TransBnk | Fintech (SaaS) | $25,000,000 | Series B | Expand globally, enhance technology and API platform |

| 2 | Altum Credo | Fintech (Lending Tech) | $19,400,000 | Undisclosed | Scale operations in Indian markets |

| 3 | CredRight | Fintech (Lending Tech) | $10,000,000 | Series B | Expand loan book, upgrade technology |

| 4 | WizCommerce | Enterprise Tech (Vertical SaaS) | $8,000,000 | Series A | US expansion, enhance AI-powered platform |

| 5 | Vutto | Ecommerce (Vertical Marketplace) | $7,000,000 | Series A | Expand used two-wheeler market presence and customer services |

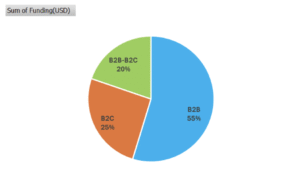

Customer Segment Analysis

B2B startups raised approximately $53.7M million, driven by fintech and enterprise tech sectors.

B2C startups garnered about $25.1 million, primarily from ecommerce, consumer services, and media ventures.

Hybrid (B2B-B2C) companies attracted nearly $19.4 million, reflecting blended market solutions.

Funding Stage Breakdown

Series A and B rounds led funding volumes, jointly totaling approximately $59.6 million. Early-stage rounds, including Seed, Pre-Series A, and Pre-Seed, collectively raised about $11 million, sustaining innovation momentum. Undisclosed rounds comprised roughly $21.8 million, signaling ongoing private investments and strategic funding.

Key Takeaways

- Fintech, Ecommerce, and Enterprise Tech received the largest share of funding, illustrating investor focus on scalable financial and technology platforms.

- Growth-stage rounds dominated funding, demonstrating confidence in startups with validated models and solid expansion plans.

- Early-stage funding remains healthy, particularly in ecommerce and consumer services sectors, ensuring continued startup innovation.

- B2B and hybrid business models show strong investment interest alongside B2C, indicating ecosystem diversity and maturity.

- Sustained funding activity across sectors and stages reflects an evolving and dynamic Indian startup ecosystem poised for long-term growth.