US Funding Insights: AI and Energy Drive Robust Funding Week

- September 1, 2025

- Posted by: spiceroute

- Category: U.S. Funding & Investment Trends

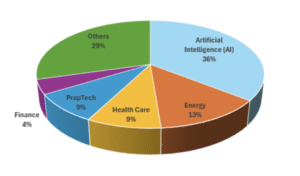

This week, 84 US startups collectively raised approximately $763 million in equity funding. The data highlights an active and evolving venture capital landscape. Artificial Intelligence (AI) remained the leading sector, securing nearly $272 million across 31 companies. Energy also emerged strongly with $100 million across key innovators. Other prominent sectors included Health Care ($68 million), PropTech ($66 million), and Finance ($33 million).

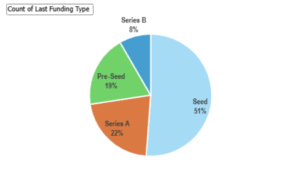

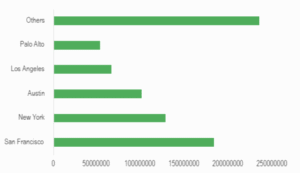

In terms of funding stages, Series A rounds led capital deployment with $297 million raised across 18 deals, followed by Series B with $281 million over 9 companies. Seed rounds maintained vitality, raising $181 million from 43 deals, while Pre-Seed rounds added $4.1 million across 16 deals. Geographically, San Francisco remained a central hub with $182 million invested across 13 startups. New York followed with $128 million across 9 companies, Austin with $100 million, and Los Angeles with $65 million.

The market signals ongoing confidence in both transformative AI-driven startups and scaling investments in energy and proptech, supported by active early-stage dealmaking.

Top Industries of the Week:

Artificial Intelligence (AI): $272 million (31 companies)

AI funding continues its robust momentum, reflecting growth across sectors including industrial automation, software, and developer tools. Notable deals include Keychain ($30 million Series B, New York) and Functionize ($41 million Series B, San Francisco), exemplifying broad investor interest in AI-enabled business solutions.

Energy: $100 million

Energy sector startups showed strong capital inflows highlighted by Aalo Atomics’ $100 million Series B round in Austin, underscoring increasing focus on clean energy and advanced manufacturing.

Health Care: $68 million

Healthcare investments remain vital, driven by startups such as Cartwheel’s $35 million Series B in Cambridge and Luna Diabetes’ $23 million Series A in San Diego.

PropTech: $66 million

Emerging PropTech ventures attracted substantial funding, including Bonus Homes’ $65 million Seed round in Los Angeles, signaling growing innovation in real estate technologies.

Additional sectors generating notable investment include Finance ($33 million), Analytics ($35 million), and Consulting ($8.6 million), revealing a diverse capital allocation landscape.

Funding Stage Analysis:

Series A: $297 million (18 deals)

Series A rounds commanded the highest capital this week, featuring scaling startups across AI, health care, and fintech. Deals such as Casca ($29 million, San Francisco) emphasize confidence in growth-stage prospects.

Series B: $281 million (9 deals)

Series B rounds showed continued appetite for mature companies, including Keychain and Functionize, reflecting increasing investor faith in company scalability.

Seed: $181 million (43 deals)

Seed funding activity remained healthy with a large number of early-stage deals fostering emerging innovation.

Pre-Seed: $4.1 million (16 deals)

Pre-Seed investments continued to nurture early ideas and nascent startups.

Outliers: Top Funded Startups

| Rank | Company | Sector | Funding | Stage | Location |

| 1 | Aalo Atomics | Energy | $100 million | Series B | Austin |

| 2 | Bonus Homes | PropTech | $65 million | Seed | Los Angeles |

| 3 | Cartwheel | Health Care | $35 million | Series B | Cambridge |

| 4 | Functionize | Artificial Intelligence | $41 million | Series B | San Francisco |

| 5 | Keychain | Artificial Intelligence | $30 million | Series B | New York |

| 6 | Casca | Artificial Intelligence | $29 million | Series A | San Francisco |

| 7 | The Better Meat Co. | Alternative Protein | $31 million | Series A | West Sacramento |

| 8 | Pylon | B2B | $31 million | Series B | San Francisco |

| 9 | Zed Industries | Creative Agency | $32 million | Series B | San Francisco |

| 10 | TinyFish | Artificial Intelligence | $47 million | Series A | Palo Alto |

Geographic Highlights:

San Francisco led the week with $182 million invested across 13 startups, followed by New York with $128 million across 9 companies. Austin saw high activity with $100 million invested, while Los Angeles attracted $65 million. Additional funding hubs include Palo Alto ($53 million) and Cambridge ($38 million), underscoring a geographically concentrated but active investment climate.

Key Takeaways:

- Strong Hub Dominance: San Francisco, New York, and Austin remain the leading funding centers, consistently drawing major capital flows.

- Sector Leadership: AI retains its dominant role, complemented by substantial investments in Energy and PropTech sectors.

- Stage Distribution: Series A and B rounds capture the majority of capital, signaling healthy growth and maturity in the startup ecosystem.

- Early-Stage Vitality: Significant Seed and Pre-Seed deal volume demonstrates enduring investor enthusiasm for innovation at all stages.

Final Thoughts:

The US startup funding landscape this week reflects robust activity totaling $763 million across 84 companies. Concentration in major hubs alongside rising investments in energy and proptech underscores dynamic growth potential. A well-balanced funding stage mix coupled with sectoral diversity maintains optimism for continued advancement and startup success.