US Funding Insights: AI Dominance & Hub Concentration Mark a Strong Week

- August 20, 2025

- Posted by: spiceroute

- Category: U.S. Funding & Investment Trends

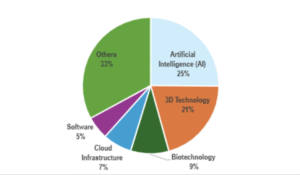

This week, 91 US startups collectively raised $1.46 billion in equity funding. The data underscores a vibrant and resilient venture capital landscape in North America, with Artificial Intelligence (AI) leading the charge. AI startups secured $366 million across 30 companies, maintaining the sector’s dominant position. Other significant sectors drawing substantial investment include 3D Technology ($300 million), Biotechnology ($132 million), and Cloud Infrastructure ($100 million).

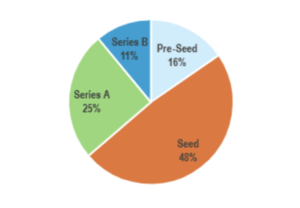

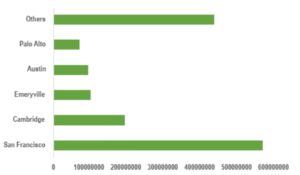

In terms of funding stages, Series A rounds topped capital raised with $508 million across 23 deals, closely followed by Seed rounds which raised $504 million in 44 deals, highlighting the strength of early-stage startup activity. Series B rounds totaled $429 million over 10 deals, while Pre-Seed saw $17 million spanning 14 deals. Geographically, San Francisco continues to dominate, attracting $566 million across 24 startups. Cambridge ($192 million) and Emeryville ($100 million) are also key innovation hubs receiving significant capital inflows.

The market environment indicates growing optimism for startup exits, with both M&A and IPO activities gaining traction alongside strong venture funding.

Top Industries of the Week:

Artificial Intelligence (AI): $366 million

AI startups raised $366 million across 30 companies, demonstrating continued investor enthusiasm. Notable companies include Salient ($60 million Series A, split across AI and Software), Positron ($51.6 million Series A, Reno), Lumana ($40 million Series A, Palo Alto), and Cline ($32 million Series A, San Francisco).

3D Technology: $300 million

3D Technology secured a sizeable $300 million, reflecting increased focus on advanced manufacturing, simulation, and industrial applications. AssetHub contributed substantially with a $300 million seed round in San Francisco.

Biotechnology: $132 million

The biotechnology sector continues to attract major funding, exemplified by ARTBIO’s $132 million Series B round in Cambridge, highlighting ongoing investor confidence in health sciences innovation.

Cloud Infrastructure: $100 million

Cloud infrastructure firms received $100 million, underscoring the importance of scalable enterprise technology, with Oxide Computer Company’s $100 million Series B in Emeryville leading this investment category.

Additional sectors drawing significant capital include Software ($80 million), Analytics ($76 million), and Cloud Management ($54 million), demonstrating robust interest across foundational and emerging technology platforms.

Funding Stage Analysis:

Series A: $508 million (23 deals)

SeriesA rounds dominated in deal volume (23 deals) and raised $508 million, exemplified by AssetHub’s $300 million seed round and numerous active early-stage startups like Stable ($28 million, Blockchain) and Deep Cogito ($13 million, AI).

Seed: $504 million (44 deals)

Seed funding remains vibrant, raising $504 million through 44 deals, illustrating a healthy pipeline of early ventures. The large volume and significant sums at this stage signal strong deal flow and investor willingness to back nascent startups.

Series B: $429 million (10 deals)

Series B rounds, emblematic of ventures moving towards scale, accumulated $429 million, with ARTBIO’s $132 million and Oxide Computer company’s $ 100 million Series B being the standout.

Pre-Seed: $17 million (14 deals)

Pre-Seed investment of $17 million across 14 deals evidences active nurturing of very early-stage startups, laying the groundwork for future innovation.

Outliers: Top Funded Startups

| Rank | Company | Sector | Funding | Stage | Location |

| 1 | AssetHub | 3D Technology | $300 million | Seed | San Francisco |

| 2 | ARTBIO | Biotechnology | $132 million | Series B | Cambridge |

| 3 | Oxide Computer Co | Cloud Infrastructure | $100 million | Series B | Emeryville |

| 4 | Salient | Software / AI* | $60 million | Series A | Cambridge / SF |

| 5 | Positron | Artificial Intelligence | $51.6 million | Series A | Reno |

| 6 | Blink Ops | Cloud Management | $50 million | Series B | Austin |

| 7 | Lumana | Artificial Intelligence | $40 million | Series A | Palo Alto |

| 8 | Legion Security | Information Technology | $38 million | Series A | New City |

| 9 | Sparrow | Employee Benefits | $35 million | Series B | San Francisco |

| 10 | Cline | Artificial Intelligence | $32 million | Series A | San Francisco |

Geographic Highlights:

San Francisco overwhelmingly led US funding this week with $566 million invested across 24 startups, reaffirming its position as a premier innovation hub. Cambridge’s $192 million and Emeryville’s $100 million further underscore robust activity in established tech clusters. Other noteworthy cities include Austin ($94 million), Palo Alto ($70 million), New York (various deals), and Reno ($51.6 million), illustrating a still concentrated but geographically diverse investment landscape.

Key Takeaways:

- Consolidation of Major Hubs: San Francisco, Cambridge, and Emeryville anchor the funding landscape, capturing the majority of capital flows.

- Sector Leadership: AI retains its apex status, while 3D Technology and Biotechnology also show strong investor appetite.

- Balanced Funding Stages: A well-distributed mix of Seed, Series A, and Series B investment reflects both emerging startup vitality and growth-stage scaling.

- Expansion of Ecosystem: Besides top hubs, cities like Austin, Reno, and Palo Alto contribute meaningfully to the capital distribution, signaling gradual geographic diversification.

Final Thoughts:

The week’s US startup ecosystem displayed strong vitality with 91 companies securing nearly $1.46 billion in total funding. AI’s dominance and the concentration of investments in principal innovation hubs emphasize ongoing confidence in transformative technologies and scalable business models. The balanced funding distribution across stages and sectors highlights a healthy and dynamic environment poised for sustained growth. Growing exit activities add to investor optimism, reinforcing an encouraging outlook for the months ahead.